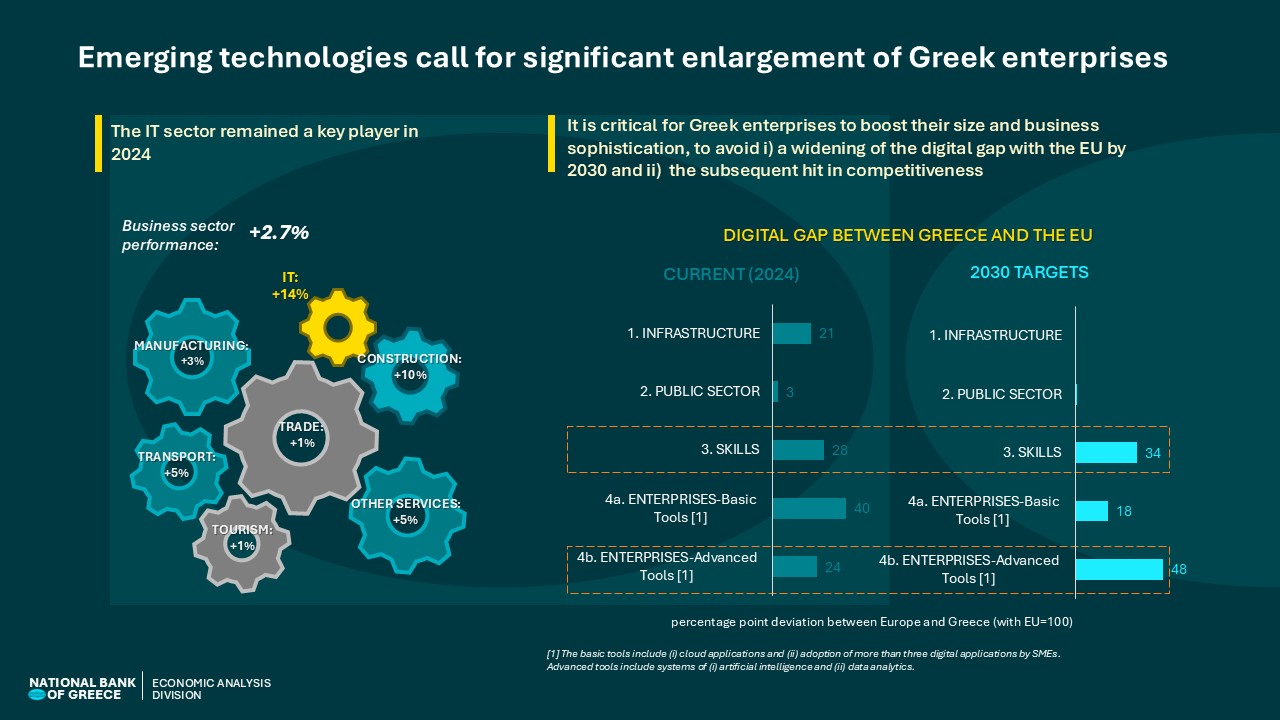

In 2024, the business sector maintained its positive momentum, recording a 2.7% increase in sales (in deflated terms), continuing the growth trend from 2023. All quarters showed positive performance, while the initial volatility smoothed out during Q3 and Q4, aligning closely with the annual average. This strong performance increased the share of the Greek business sector in the EU economy to 1.1% in 2024 (up from 1.0% during 2016–2021), although it remains below the pre-crisis level of 1.7%. Looking ahead, we expect the growth trend to continue in 2025, at a pace of around 3%.

Business support and investment-related activities stood out in 2024, posting an 8% increase in deflated terms – significantly higher than the 2% growth recorded across other sectors. This was driven by (i) efforts to close the investment gap and (ii) incentives provided through the Recovery Fund. The IT sector continued to deliver strong results, increasing its share of GDP to 1.6% in 2024, up from 0.7% in 2014 and 0.4% in 2004. Despite this progress, Greece remains at the bottom of the EU rankings, as the European average stands at 3.3%, with most countries having already converged toward that level.

Further growth of the IT sector is critical to enhancing the competitiveness of the Greek economy, as it can significantly boost productivity. Over the medium term, we estimate that a 1 percentage point increase in the sector’s share of GDP could boost national productivity by 15%. A robust existing core of businesses sustains the sector's momentum, which – although small by EU standards – shows strong potential, with R&D spending reaching 11% of value added, more than double the EU average of 5%. Continued expansion is expected to drive investment in software, rebalance the hardware-software mix, and ultimately improve returns on digital investments.

However, IT sector growth cannot occur in isolation. It will depend on rising demand for business digitalization - a goal aligned with the EU's “Digital Decade” framework for 2030.

- The first step has already been taken, with improvements to the digital environment. Digital infrastructures (e.g., fiber optics, 5G) and public sector digitalization are expected to achieve full convergence with the EU by 2030.

- What continues to impede progress is the significant lag in two critical areas: (i) the digital maturity of businesses and (ii) workforce digital skills. These gaps partly reflect broader limitations in the size and business culture of Greek enterprises. Without structural reforms, there is a visible risk over the next five years of (i) maintaining gaps in basic skills and tools and (ii) widening disparities in advanced technologies such as AI - potentially offsetting some of the benefits from infrastructure convergence (with estimated utilization rate of c.40% by 2030, compared to 67% EU average).

As this lag is expected to severely impact the competitiveness of the Greek economy over the next decade - when 70% of new value added is expected to be digitally enabled – convergence with the EU must become an urgent priority. This is an ambitious task, requiring (i) nearly all businesses to reach at least a basic level of digitalization (up from around 50% currently) and (ii) 75% of them to adopt advanced digital tools (up from 10–25% currently). Achieving this will require a strong focus on business enlargement, which will be key to enabling digital transformation and triggering a virtuous cycle of productivity growth.

See the infographic: