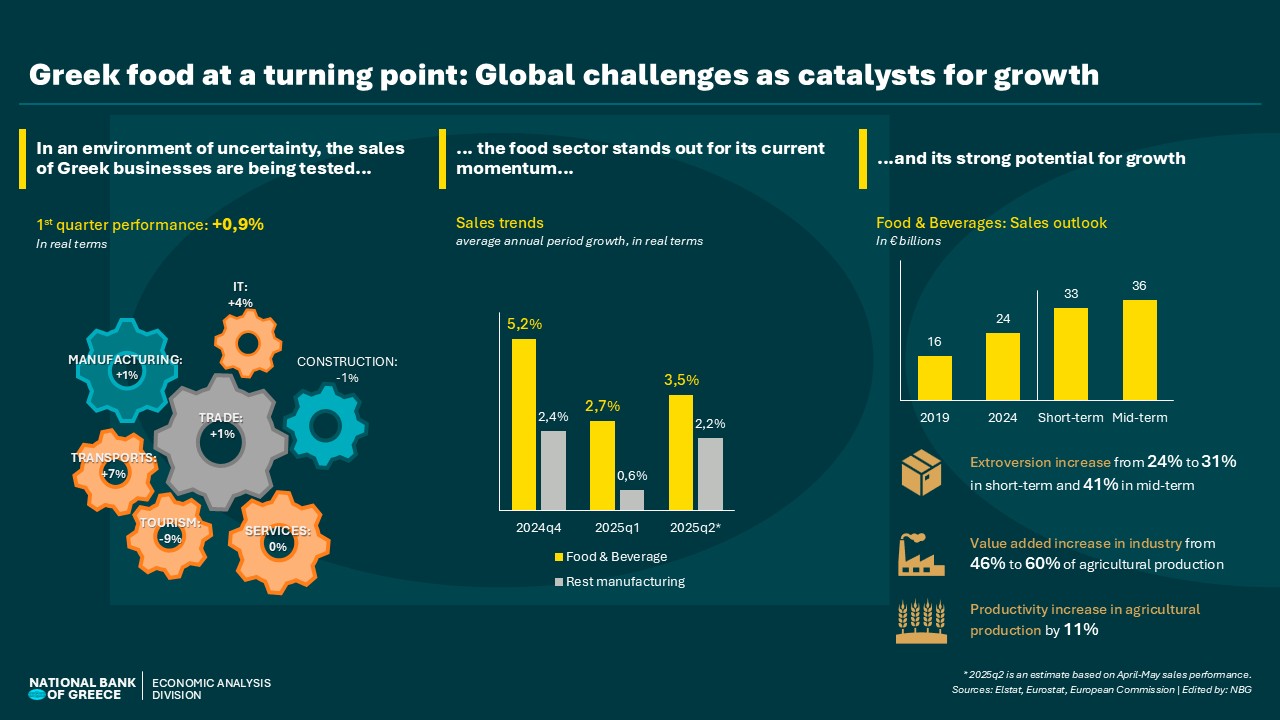

While the business sector maintained positive growth in sales during Q1:2025 (+0.9% in real terms), there is a notable slowdown in performance compared to 2024 (+3%), due to mounting international pressures (such as geopolitical instability and tariff tensions). For the remainder of the year, we expect a gradual improvement in conditions, allowing for an overall performance of around 2.3% for 2025 (in real terms), in line with i) early signs from Q2 and ii) the 15% tariff agreement on European exports to the US, which helps reduce uncertainty around more adverse scenarios.

In this environment of modest performance, the food and beverage sector stands out for its growth momentum, showing an increase of +3.1% over the past six months in real terms – clearly outperforming the rest of the manufacturing sector (+1.5% over the same period). This outperformance is a natural continuation of a gradual strategic strengthening of the sector. First, the sector has shown sales resilience over the past 25 years, with mild fluctuations even during recession periods. At the same time, over the past decade, it has made significant progress in critical indicators: return on assets has nearly doubled (from 2.2% before the crisis to 3.9%), while exports accounted for 24% of sales in 2024 (up from 13% in 2014), approaching the European average of 26%.

International demand for Greek food represents a strategic advantage. In a context of heightened global trade uncertainty, this demand can act as a catalyst for the sector’s next leap — provided it is leveraged through targeted interventions. The sector’s medium-term growth potential can rest on two main pillars.

- First, increasing the added value food processing brings to agricultural production, which currently stands at just 46%, compared to 60% in the EU. Aligning with the European average could yield an additional €2 billion in added value (+32%).

- Second, improving the productivity of the primary sector (per area), which currently lags by around 11% compared to the EU. Aligning on this front could boost the sector’s total added value by €3 billion (+50%).

To absorb the increased production, a simultaneous boost in extroversion is required: reaching 31% of sales in the short term and 41% in the medium term — levels comparable to other small but highly export-driven European economies.

Transitioning to this new production model requires coordinated structural reforms. According to a model by the National Bank of Greece, the key factors linked to transitioning to a high value-added agri-food sector are: i) strengthening research and development (precision agriculture, processing technology, branding) and ii) creating cooperation schemes (clusters, cooperatives) to achieve economies of scale.

In a time of trade tensions, global volatility, and a reshuffling of European funding priorities, the food and beverage sector has the opportunity — not just the potential — to evolve into a structural growth driver for the Greek economy.

See the infographic: