As Europe simplifies its ESG framework through the recent reforms of the “Competitiveness Compass”, assessing the relationship between Greek businesses and ESG principles becomes critically important. The Economic Analysis Division of the National Bank of Greece, using field research conducted on 600 SMEs, (i) maps the current level of knowledge and implementation of ESG policies in Greece and (ii) explores how institutional changes will affect the degree and nature of their adoption. The main finding of the study highlights that the simplification of ESG standards "unlocks" opportunities for Greek businesses to gain operational benefits and become more competitive.

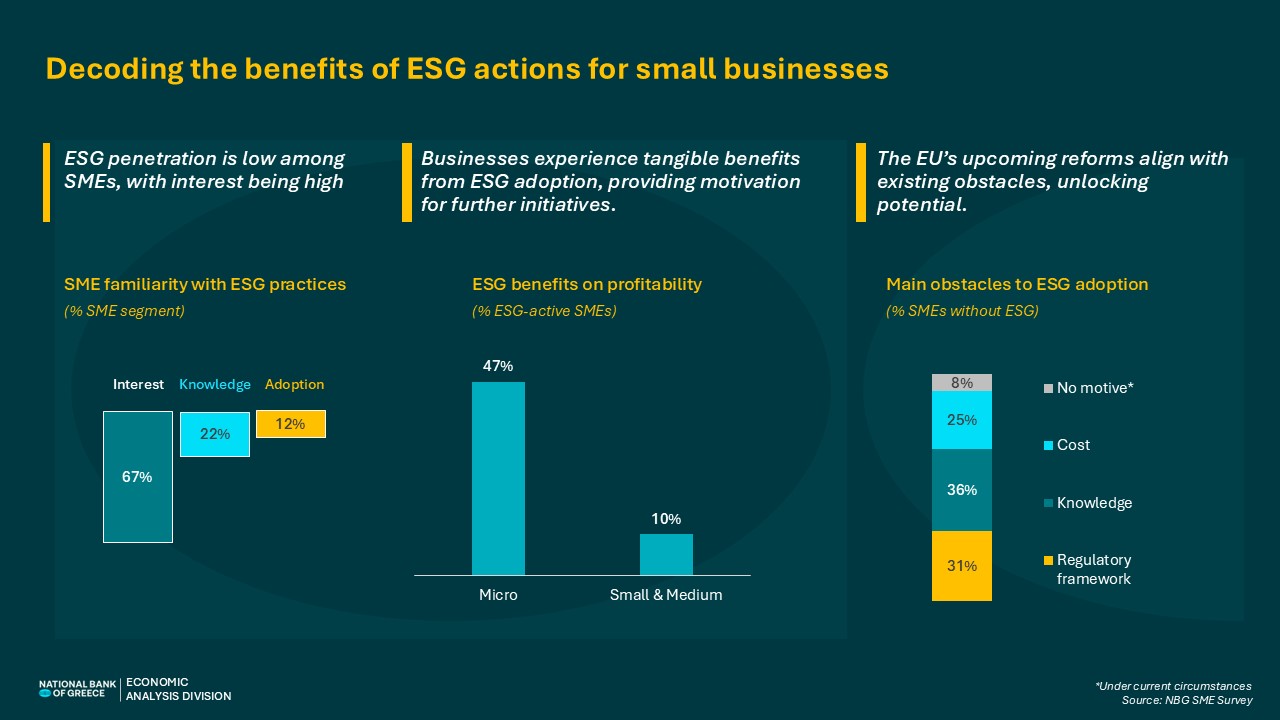

A key aspect of the research is the identification of a significant gap between the strong interest of SMEs in ESG initiatives and their low practical adoption. Specifically, a high percentage of SMEs (over two-thirds) express active interest in ESG actions; however, only a small portion has received substantial information (just 22%), and an even smaller percentage has proceeded with adopting related actions (12% of the SME sector and only 4% among very small enterprises). Focusing on the types of actions being taken, the findings reveal that:

- Almost all businesses that have implemented ESG actions have undertaken some form of initiative in the environmental (E) dimension, such as recycling, energy efficiency upgrades, or environmentally friendly products.

- Following that, actions related to the social (S) dimension are implemented by 7% of SMEs, such as practices ensuring employee equality or customer satisfaction surveys, while

- Only 3% of the sector has advanced to a holistic ESG strategy, adding to the above actions the governance (G) dimension, either through the preparation of sustainability reports or by communicating practices to employees and partners.

Therefore, there is significant room for further penetration of ESG practices in Greek businesses, with the role of information being crucial—considering that one-third of businesses without ESG actions cite lack of relevant knowledge as the primary reason.

Despite the limited adoption, an extremely important finding emerged from our analysis: one-third of businesses with ESG strategies already recognize tangible operational benefits, while the remaining two-thirds report satisfaction (without having yet quantified the positive impact). Beyond the largely expected benefits in terms of easier access to partnerships and financing, the most interesting result is the already measurable positive effect on profitability identified by the businesses themselves, which appears even stronger among very small enterprises (covering nearly half of them). The recognition by SMEs of ESG principles as a source of revenue and profitability confirms that these actions address structural issues stemming from their small size:

- Environmental actions are largely associated with cost reduction (e.g., energy savings).

- Social actions can attract customers as well as skilled personnel, leading to business growth.

- Governance actions enhance strategic maturity and business culture.

As expected, a holistic ESG strategy works multiplicatively, maximizing operational benefits.

The significance of this finding is twofold as, beyond the immediate benefits, raising awareness among businesses that are still hesitant, can serve as a strong incentive for adoption—given that over two-thirds of them cite operational benefits (such as cost reduction and increased demand) as the primary reason that would encourage them to take the step.

Expanding on this conclusion, our research highlights that the vast majority of SMEs (93% of the sector) do not require mandatory regulations as an incentive for ESG actions. Under these circumstances, the relaxation of the mandatory nature of ESG actions within the EU regulatory framework is not expected to have a deterrent effect on the aforementioned outlook. On the contrary, the proposed regulations in the EU significantly alleviate barriers within the regulatory framework, as:

- The ESG sector is included in the first package of measures aimed at reducing bureaucratic burden for SMEs, with an estimated cost saving of €6.3 billion across the EU (which, combined with related easing of procedures for banking institutions, will facilitate the financing of ESG actions).

- Obligations for complex reporting related to the inclusion of SMEs in the value chains of larger companies are reduced, facilitating such collaborations (especially with large enterprises).

The above changes are expected to mobilize a significant portion of Greek businesses, as complex procedures (and the resulting high costs) are recognized by the majority of SMEs as the main barrier preventing them from adopting ESG policies.

Therefore, considering (i) the strong interest of SMEs in ESG actions, (ii) their proven positive effects on the operational business performance, and (iii) the favorable impact of EU reforms, the environment is conducive for Greek SMEs to strategically adopt ESG practices and enhance their competitiveness.

See the infographic: