More specifically,

- The ECB Board attaches greater importance to the (certain) upward surprises of inflation than to the (uncertain) downside risks to growth.

- Moreover, ECB Head stressed that first interest rate rise is expected in July (vy 25 base points), while subjected that the expected rise in September might be higher.

So a company, regardless of the type of financing it has acquired, whether a bond loan or working capital, regardless of where the specific financing is held, can hedge the market risk and stabilize the base interest rate at very low levels by using the appropriate financial tools.

This can be achieved by selecting interest rate exchange products where the Bank undertakes to pay you the respective Euribor and you pay the pre-agreed fixed interest rate.

This strategy changes the interest rate profile of your Company's financing from fluctuating to fixed and is protected from interest rate fluctuations, ensuring fixed financing costs regardless of interest rate conditions.

Alternatively your company can manage the financing cost by choosing a maximum limit beyond which the Bank undertakes to reimburse you for a fee. This structure allows the Company's liabilities to be charged with interest at a floating interest rate, while setting a maximum limit that the floating interest rate can reach.

The aforementioned transactions are fully customizable according to the needs of the client. What we are essentially achieving is enabling structured cash flows so that companies can budget the total cost of financing.

Managing energy prices

One of the major uncertainties that has emerged in recent years, and affects the final cost of the product produced by companies, is the cost of energy. The key driver behind the significance that energy costs have acquired in the business model is, in principle, the 'green transition' policy deployed by the EU.

In particular, the European Commission (E.C.) recently adopted a directive aiming to reduce clean emissions by 55% by 2030 with the ultimate goal of achieving climate neutrality by 2050.

This directive is a key point in terms of the electricity generation mix in the EU and especially in Greece, which has adopted a strategic plan to achieve these objectives.

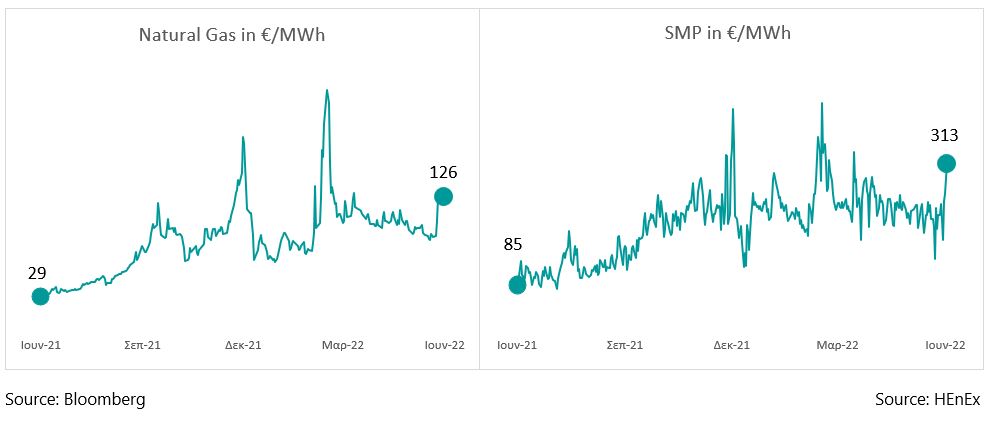

Graph: TTF Natural Gas fluctuation and System Marginal Price (SMP)